Curious about cryptocurrencies? Getting started can be intimidating, but with the right guidance, it’s manageable. This post will walk you through the steps of buying and selling cryptocurrencies. You’ll learn to set up your wallet and execute trades. Remember, cryptocurrency markets are volatile and prices can change rapidly. With caution and patience, you can potentially reap significant rewards.

Key Takeaways:

- Choose a Reputable Exchange: When buying and selling cryptocurrencies, it’s imperative to select a reliable and trustworthy exchange platform. Research and compare different exchanges to find one that offers competitive fees, robust security measures, and a user-friendly interface.

- Understand Cryptocurrency Wallets: A cryptocurrency wallet is a digital storage space that holds your cryptocurrencies. You can choose between different types of wallets, such as software wallets, hardware wallets, and paper wallets. Make sure to understand how to set up and manage your wallet securely to protect your assets.

- Set Clear Investment Goals and Strategies: Before buying and selling cryptocurrencies, define your investment goals and develop a clear strategy. Determine your risk tolerance, set a budget, and decide whether you’re in it for the long haul or looking for short-term gains. This will help you make informed decisions and avoid impulsive trades.

Understanding Cryptocurrencies

While venturing into the world of cryptocurrencies, it’s imperative to have a solid understanding of what they are, the different types, and how they work.

What are Cryptocurrencies?

While exploring the concept of cryptocurrencies, you’ll find that they are digital or virtual currencies that use cryptography for security and are decentralized, meaning they’re not controlled by any government or financial institution.

Types of Cryptocurrencies

While delving into the world of cryptocurrencies, you’ll come across various types, each with its unique features and purposes.

- Bitcoin (BTC): the first and most well-known cryptocurrency

- Ethereum (ETH): focuses on smart contracts and decentralized applications

- Altcoins: alternative cryptocurrencies that are not Bitcoin or Ethereum

- Stablecoins: pegged to the value of a fiat currency to reduce volatility

- Tokens: represent a particular asset or utility

Perceiving the differences between these types will help you make informed decisions when buying and selling cryptocurrencies.

| Type | Description |

| Bitcoin (BTC) | The first and most well-known cryptocurrency |

| Ethereum (ETH) | Focuses on smart contracts and decentralized applications |

| Altcoins | Alternative cryptocurrencies that are not Bitcoin or Ethereum |

| Stablecoins | Pegged to the value of a fiat currency to reduce volatility |

What’s important to note is that each type of cryptocurrency has its unique features, advantages, and disadvantages. Understanding these differences will help you navigate the cryptocurrency market with confidence.

How Cryptocurrencies Work

Assuming you’re familiar with the basics of cryptocurrencies, you’ll want to know how they function.

Understanding how cryptocurrencies work will give you a deeper appreciation for the technology behind them. Cryptocurrencies use a decentralized system, where transactions are recorded on a public ledger called a blockchain. This decentralized system allows for secure, transparent, and fast transactions without the need for intermediaries like banks.

Importantly, cryptocurrencies are not backed by any government or institution, and their value can fluctuate rapidly. However, this also means that you have full control over your cryptocurrency assets, and you can use them to make transactions or investments without needing permission from anyone.

Preparing to Buy Cryptocurrencies

There’s a lot to consider before plunging into the world of cryptocurrency trading. To ensure a smooth and secure experience, it’s important to take the necessary steps to prepare yourself.

Choosing a Cryptocurrency Exchange

There’s no shortage of cryptocurrency exchanges to choose from, but not all are created equal. When selecting an exchange, consider factors such as security, fees, and the range of cryptocurrencies offered. Look for exchanges with a strong reputation, robust security measures, and a user-friendly interface.

Setting Up a Digital Wallet

Some cryptocurrency exchanges offer built-in digital wallets, but it’s recommended to set up an external wallet for added security. This will give you full control over your private keys and ensure that your funds are protected.

It’s important to understand that digital wallets come in different forms, such as software wallets, hardware wallets, and paper wallets. Each type has its own advantages and disadvantages, so it’s crucial to choose the one that best suits your needs. Hardware wallets, for example, are considered to be the most secure option, but they can be more expensive.

Funding Your Account

There’s more than one way to fund your cryptocurrency exchange account. You can use traditional payment methods like credit cards, debit cards, or bank transfers, or you can use alternative methods like PayPal or other cryptocurrencies. Be aware that some funding methods may come with higher fees or longer processing times.

Choosing the right funding method is crucial, as it can affect the overall cost of your transaction. Be sure to research the fees associated with each method and consider the security risks involved. Additionally, make sure you understand the exchange’s deposit and withdrawal policies to avoid any potential issues.

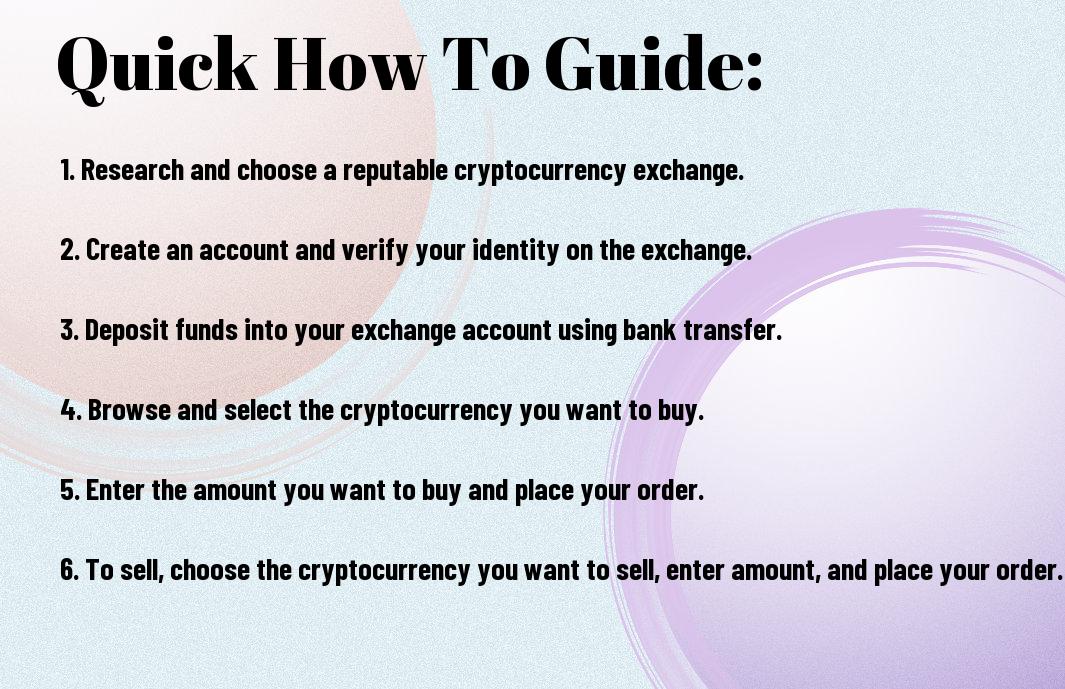

How to Buy Cryptocurrencies

Many people are interested in buying cryptocurrencies, but they don’t know where to start. Fortunately, the process is relatively straightforward, and with a little guidance, you can start building your cryptocurrency portfolio.

Placing an Order

Positioning yourself for success begins with placing an order. Placing a buy order is a simple process that involves specifying the amount of cryptocurrency you want to purchase and the price you’re willing to pay. You can usually do this through an online exchange or brokerage platform.

Understanding Market Orders and Limit Orders

Assuming you’re new to buying cryptocurrencies, you may not be familiar with the different types of orders. Understanding the difference between market orders and limit orders is crucial to making informed investment decisions.

It’s vital to understand that market orders execute immediately at the current market price, whereas limit orders allow you to set a specific price at which you’re willing to buy. This can help you avoid overpaying for a cryptocurrency.

Tips for Buying Cryptocurrencies

Any investor looking to buy cryptocurrencies should keep the following tips in mind:

- Research, research, research: Make sure you understand the cryptocurrency you’re buying and its potential risks and benefits.

- Set a budget: Decide how much you’re willing to spend and stick to it.

- Use strong passwords: Protect your accounts with strong, unique passwords.

After you’ve taken these precautions, you can confidently start building your cryptocurrency portfolio.

A key aspect of buying cryptocurrencies is understanding the fees associated with each transaction. Be aware of the fees charged by exchanges and brokerages, as they can eat into your profits. Additionally, consider using a reputable exchange and enabling two-factor authentication to protect your accounts. After all, security should be your top priority when buying cryptocurrencies.

Factors to Consider When Buying Cryptocurrencies

Keep in mind that buying cryptocurrencies involves risks, and it’s necessary to consider several factors before making a purchase. Here are some key considerations:

- Market Volatility: The cryptocurrency market is known for its rapid price fluctuations.

- Liquidity: Ensure that you can easily buy and sell your chosen cryptocurrency.

- Security and Regulation: Verify that the exchange or platform you’re using is secure and compliant with regulatory requirements.

- Fees and Charges: Understand the fees associated with buying, selling, and storing your cryptocurrencies.

After considering these factors, you’ll be better equipped to make informed decisions when buying cryptocurrencies.

Market Volatility

The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. This means that the value of your investment can increase or decrease significantly in a short period.

Liquidity

Even with a well-known cryptocurrency, liquidity is crucial. Ensure that you can easily buy and sell your chosen cryptocurrency without significantly affecting its price.

Factors such as trading volume, order book depth, and the number of buyers and sellers can impact liquidity. A cryptocurrency with high liquidity is generally easier to buy and sell.

Security and Regulation

You should only use reputable exchanges and platforms that prioritize security and comply with regulatory requirements. Look for platforms that have implemented robust security measures, such as two-factor authentication, cold storage, and regular security audits.

It’s necessary to verify that the platform you’re using is registered with the relevant authorities and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Fees and Charges

Now that you’ve found a secure and reputable platform, it’s time to consider the fees associated with buying, selling, and storing your cryptocurrencies. Be aware of the transaction fees, withdrawal fees, and any other charges that may apply.

Cryptocurrencies with lower fees can be more attractive, but be cautious of platforms with extremely low or no fees, as they may compromise on security or liquidity.

How to Sell Cryptocurrencies

Despite the volatility of the cryptocurrency market, selling your digital assets can be a lucrative move. If you’re new to the world of crypto, you may want to start by learning How to Buy Cryptocurrency: What Investors Should Know. Once you’ve got a grasp on buying, it’s time to learn how to sell.

Placing a Sell Order

Some exchanges allow you to place a sell order, which will automatically execute when the cryptocurrency reaches a certain price. This can be a convenient way to sell your assets without constantly monitoring the market.

Understanding Stop-Loss Orders

Assuming you’re looking to minimize losses, you may want to consider placing a stop-loss order. This type of order will automatically sell your cryptocurrency if it falls below a certain price.

Sell orders can be especially useful in volatile markets, where prices can fluctuate rapidly. By setting a stop-loss order, you can limit your potential losses and protect your investment.

Tips for Selling Cryptocurrencies

Assuming you’re ready to sell, here are some tips to keep in mind:

- Set realistic prices: Don’t expect to sell your cryptocurrency at an inflated price. Research the current market value and set a competitive price.

- Use strong security measures: Make sure your exchange account is secure, and use two-factor authentication to protect your assets.

- Keep an eye on fees: Different exchanges charge varying fees for selling cryptocurrencies. Be aware of these fees and choose an exchange that offers competitive rates.

Perceiving the market trends and adjusting your selling strategy accordingly can help you maximize your profits.

Cryptocurrencies are known for their volatility, so it’s vital to stay informed and adapt to changing market conditions. By following these tips and understanding how to sell cryptocurrencies, you can make informed investment decisions and potentially profit from your digital assets.

Important: Always do your own research and consider your own risk tolerance before selling cryptocurrencies. The cryptocurrency market can be unpredictable, and prices can fluctuate rapidly.

Advanced Trading Strategies

After mastering the basics of buying and selling cryptocurrencies, you can move on to more advanced trading strategies to maximize your returns. These strategies require a deeper understanding of the market and its trends, as well as a higher level of risk tolerance.

Here are some advanced trading strategies you can consider:

- Day Trading Cryptocurrencies

- Swing Trading Cryptocurrencies

- Long-Term Investing in Cryptocurrencies

Before we investigate each strategy, it’s important to note that you should always do your own research and never invest more than you can afford to lose. You can also consider using reputable platforms like Crypto.com | Securely Buy, Sell & Trade Bitcoin, Ethereum… to buy, sell, and trade cryptocurrencies.

| Strategy | Description |

|---|---|

| Day Trading | Buying and selling cryptocurrencies within a single trading day |

| Swing Trading | Holding cryptocurrencies for a shorter period, usually a few days or weeks |

| Long-Term Investing | Holding cryptocurrencies for an extended period, usually months or years |

Day Trading Cryptocurrencies

To succeed in day trading, you need to be able to analyze market trends and make quick decisions. You’ll need to stay glued to your screens throughout the trading day, ready to pounce on opportunities as they arise. Be prepared for high risks and potential losses, as the cryptocurrency market can be highly volatile.

Swing Trading Cryptocurrencies

To swing trade effectively, you need to identify trends and patterns in the market. You’ll hold your cryptocurrencies for a shorter period than long-term investing, but longer than day trading. Be prepared to adapt to changing market conditions, as swing trading requires a flexible approach.

A key aspect of swing trading is identifying the right entry and exit points. You’ll need to set clear targets and stop-losses to minimize your losses and maximize your gains. Swing trading can be a profitable strategy, but it requires patience and discipline.

Long-Term Investing in Cryptocurrencies

Now that you’ve considered day trading and swing trading, it’s time to explore long-term investing. This strategy involves holding cryptocurrencies for an extended period, usually months or years. Long-term investing can be less stressful, as you’re not constantly monitoring the market.

Trading cryptocurrencies for the long term requires a deep understanding of the underlying technology and market trends. You’ll need to conduct thorough research and stay up-to-date with market news and developments. Long-term investing can be a profitable strategy, but it requires patience and a long-term perspective.

To wrap up

With this in mind, you now have a solid understanding of how to buy and sell cryptocurrencies. You’ve learned about the different types of exchanges, wallets, and payment methods available to you. You’ve also grasped the importance of security, research, and patience when navigating the crypto market. As you commence on your cryptocurrency journey, remember to stay informed, diversify your portfolio, and set realistic goals. With time and practice, you’ll become a pro at buying and selling cryptocurrencies, and your financial future will thank you.